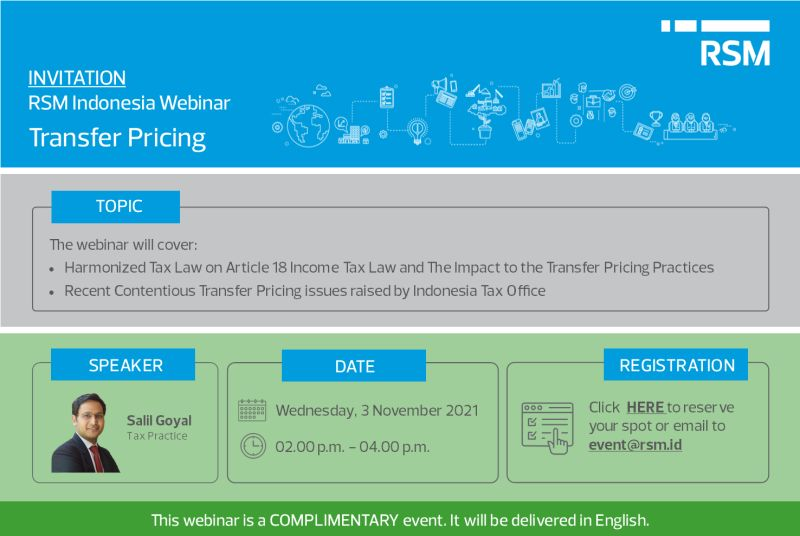

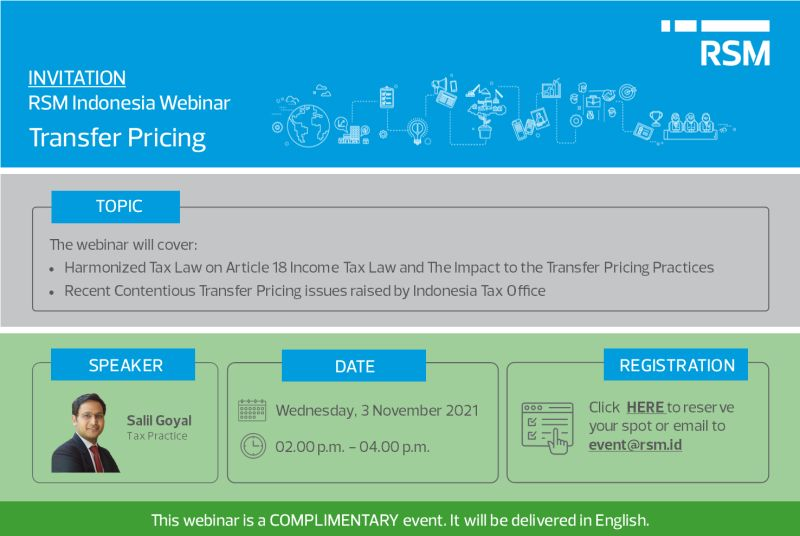

Event Provider

RSM Indonesia

Indonesia

Event Details

Transfer Pricing

3rd November 2021

It is important to understand the recent transfer developments in Indonesia at the policy level. The proposed amendment in Article 18 of the Income Tax Law (ITL) to introduce Harmonized Tax Law may have far reaching implications on MNEs operating in Indonesia. Significant changes to article 18 of the ITL includes: Transfer Pricing Method, Thin Capitalization, Anti-Stepping, Controlled Foreign Corporations, and Anti-Conduit.

Furthermore, we also intend to cover some of the contentious transfer pricing issues faced in the tax audits relevant for businesses facing losses due to Covid 19, intra-group services, and intangible transactions.

This webinar will be delivered in English.

https://www.rsm.global/indonesia/en/events/transfer-pricing

Speaker:

Salil Goyal - Tax Practice

Date:

Wednesday, 3 November 2021

Time:

02.00pm - 04.00pm

Event location:

Link to access the webinar will be provided after registration and send to your registered email prior the webinar date. Maximum 300 participants in each webinar.

Author

-

RSM Indonesia

Indonesia