Event Provider

RSM Indonesia

Indonesia

Event Details

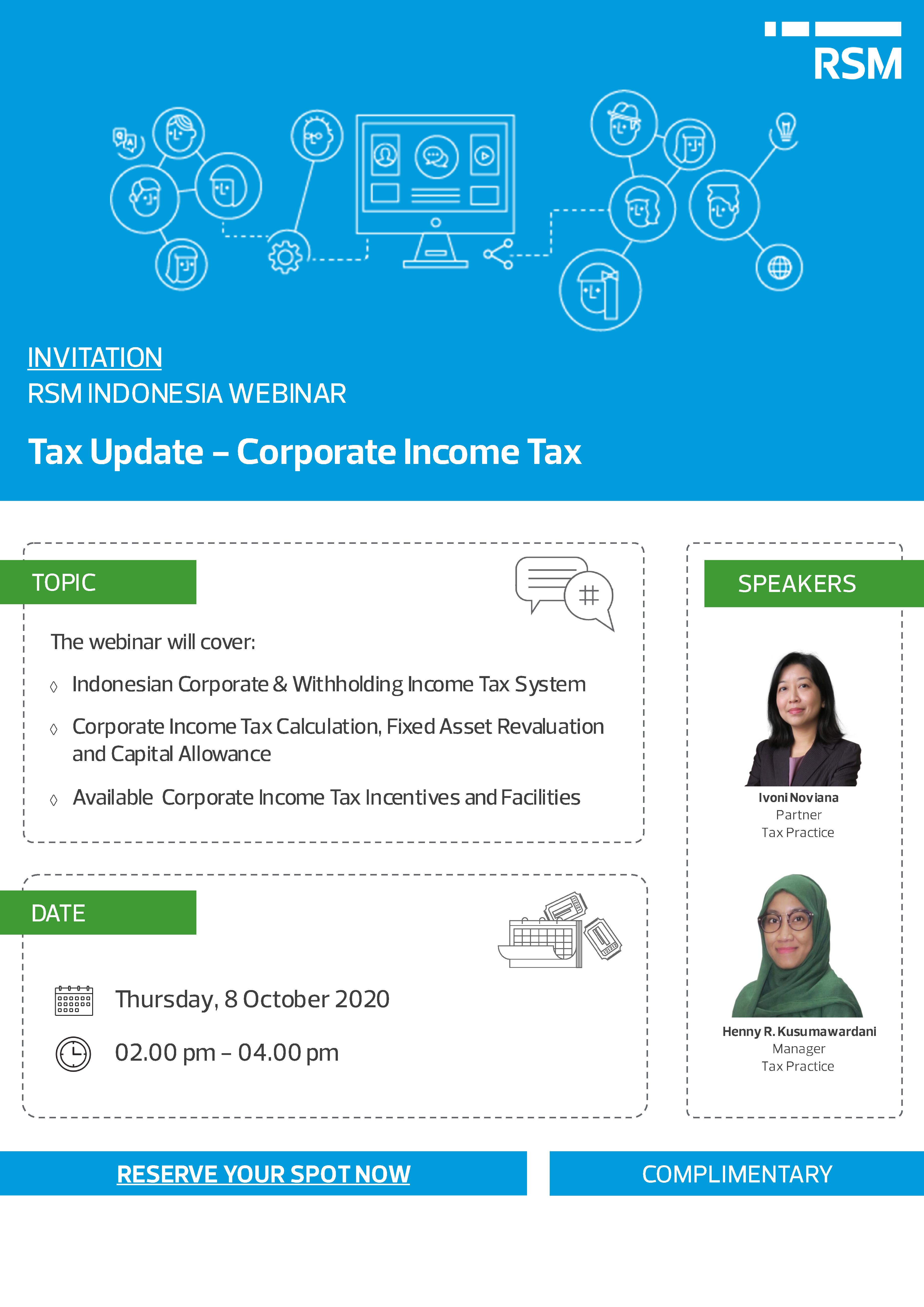

Tax Update - Corporate Income Tax - Invitation: RSM Indonesia Webinar

8th October 2020

RSM is hosting a webinar on Thursday, October 8, 2020 from 02.00 pm to 04:00 pm.

Strict compliance on corporate income tax and withholding tax compliances are the best way to defend the position in any future tax audits. Corporate income tax return must be submitted annually and will become final after 5 years unless any audit is performed during the period. Other monthly tax returns must also be submitted on monthly basis by all taxpayers and these may also be subject to tax audits. Some taxpayers are performing their corporate income tax calculation periodically due to required regulations and or internal requirements.

RSM considers that developing a robust tax compliance system is a must under the current situation and also to anticipate future changes in regulations and uncertainties in tax audit trends. For this purpose - RSM is organizing its webinar to keep all clients and friends updated on critical tax regulations and provide insight of the current environment in tax audits.

Register here to join the webinar:

*The webinar will be delivered in bahasa Indonesia.

Author

-

RSM Indonesia

Indonesia